FAQs about those tax advisory votes

We’re getting lots of questions about a relatively new form of ballot measure in Washington state — the statewide tax advisory vote. Here are some FAQs to help shed some light:

- Q. What are these Advisory Votes 3 through 7 that I see in my Voters’ Pamphlet?

- A. These are nonbinding measures that let voters say whether they think the Legislature should “repeal” or “maintain” revenue-generating bills that lawmakers passed this year. The Legislature used the $200 million from these revenue sources to help balance the new two-year budget.

- Q. What taxes are we talking about?

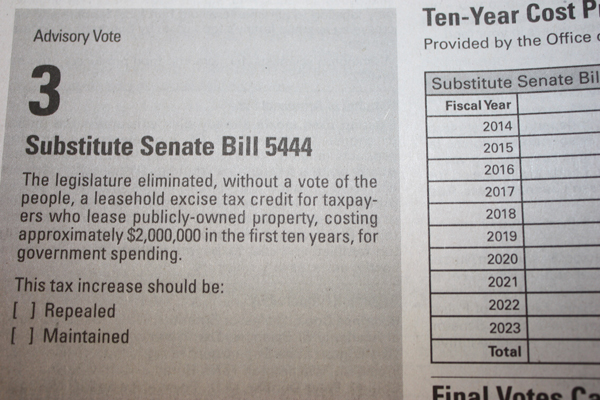

- A. There are five separate revenue bills that are subject to the advisory vote process this election. They don’t deal with familiar statewide taxes like sales, B&O or property taxes, but rather lesser-known taxes including the leasehold excise tax, commuter aircraft, pediatric dental insurance coverage, telecommunications services, and estate taxes on estates of over $4 million. Each tax gets a separate advisory vote.

- Q. So if a majority of the public vote goes for the “repeal” option, the tax will go away?

- A. No, the vote is nonbinding. That means the Legislature can take note of the public vote — or not. There is not an automatic repeal, as could happen with a regular referendum or initiative process.

- Q. Where did this advisory vote idea came from? First I’ve heard of it.

- A. Actually, it came from a little-noticed provision of Initiative 960 approved back in 2007. That was Tim Eyman’s measure that required a two-thirds vote in both houses for the Legislature to raise taxes in Olympia. (That measure passed, but the State Supreme Court later threw out the two-thirds requirement as unconstitutional.) The 2007 debate and press coverage focused almost exclusively on the two-thirds issue, but I-960 also said that if lawmakers passed taxes in Olympia, it would automatically trigger a tax advisory vote in the next general election.

- Q. And this is the first time we’ve had these advisory votes on the ballot?

- A. Well, no. We voted on No. 1 and No. 2 last fall. They didn’t get a whole lot of attention because that was the big presidential election year, including electing our governor and all the statewide officials, the U.S. House delegation, most of the Legislature and, oh, did we mention gay marriage and marijuana legalization?

- Q. What happened with those two advisory votes? What were they about?

- A. One imposed a higher tax rate on some large out-of-state banks and the other lowered the petroleum tax but extended its life over a longer-than-originally-approved number of years. The “repeal” vote prevailed in both cases. The Legislature, facing a multibillion-dollar budget gap, did not seriously consider repeal of taxes that had been approved overwhelmingly by both houses and were being used to balance the budget.

- Q. Is that why this year’s advisory vote numbers start with No. 3?

- A. Exactly.

- Q. Another question: Why are the tax issues presented the way they are in the Voters’ Pamphlet? There’s no description or summary by the Attorney General that gives me some background on each bill, and I don’t see pro and con arguments. All I see are the bill numbers, the statement that my legislators passed it “without a vote of the people,” a few lines on the subject matter and that it goes for “government spending.”

- A. The language is spelled out in the initiative, right down to the phrases you mentioned. The 10-year revenue projection, unlike the six-year projection used by agencies and budgetwriters, is required, and is prepared by the governor’s budget office. There is no provision for pro and con statements or any background information explaining the tax or what it pays for. Wordsmiths in the Attorney General’s Office are not permitted to write the explanatory statements or ballot title, as they do for initiatives and referenda. Those statements are subject to court review for bias or because one side or the other wants different wording. In the case of advisory votes, the AG fills in the blanks that are provided in I-960 and the Secretary of State likewise is not permitted to add explanatory information about each measure.

- Q. Why do I see 147 legislators’ name, addresses, email, etc.?

- A. Again, that is mandated by I-960, along with how each one voted on each of the revenue bills. Presumably that is so a voter can contact their delegation to ask questions or give feedback for or against their tax votes.

- Q. Where can I get more information?

- A. Voters can access the full text of the five bills from the Online Voters’ Guide. For each advisory vote, there is a link called “Full Text” in the upper right hand corner. Voters can get more information about the 10-year cost projection via the Online Voters’ Guide, by linking to the link called “Office of Financial Management.” The Secretary of State’s Office generally does not answer questions about the substance of legislation or why the Legislature passed it. The Legislative Hotline is 1 (800) 562-6000.

One thought on “FAQs about those tax advisory votes”

The tax advisory votes are so poorly worded that it is hard to make any sense of them. Is there no simple way of making them easier to understand? I did find a link on the League of Women Voters site that was helpful.

Comments are closed.